How to Manage Debt Effectively: Practical Strategies to Regain Financial Control

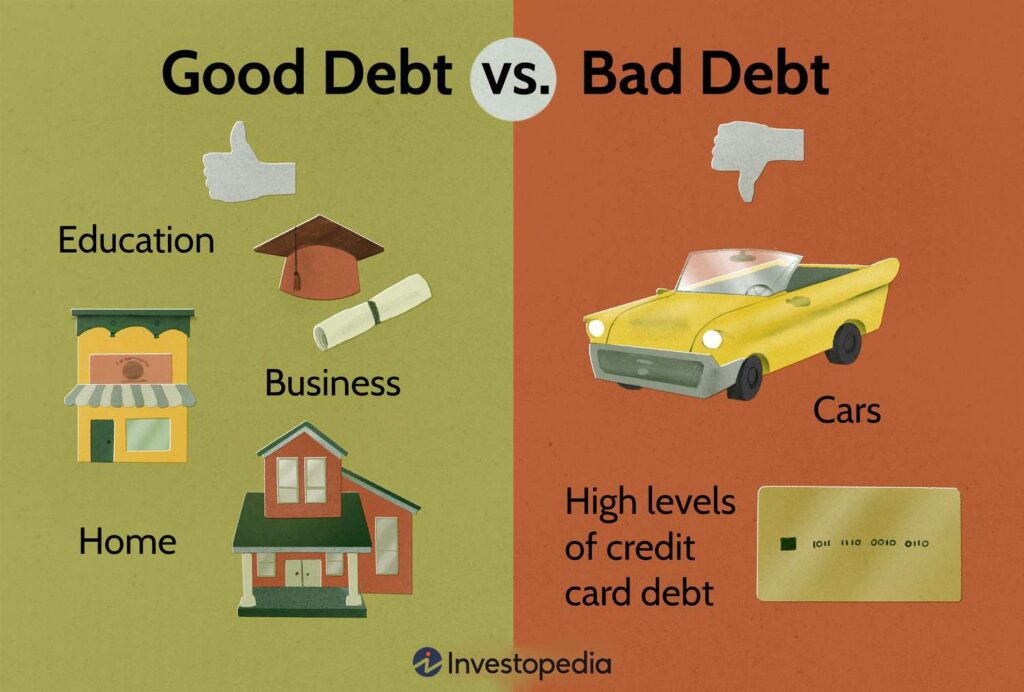

Debt is a common part of modern financial life—whether it’s from credit cards, student loans, personal loans, or mortgages. While not all debt is bad, unmanaged or high-interest debt can become overwhelming, stressful, and a major barrier to achieving financial goals.

The good news is that with the right strategies and a commitment to change, you can take control of your debt, reduce financial stress, and work toward a debt-free future. This guide explores smart ways to manage and pay off debt, including popular methods like the debt snowball and debt consolidation.

1. Know Your Numbers

Before you can effectively manage your debt, you need a clear picture of your current situation.

Start by listing:

- All your debts (credit cards, loans, etc.)

- Outstanding balances

- Minimum monthly payments

- Interest rates

This will help you understand where your money is going and which debts are costing you the most. Use a spreadsheet or a budgeting app to organize everything in one place.

2. Create a Budget That Works

A solid budget is the foundation of debt management. Knowing how much money you have coming in and going out each month helps you avoid new debt and frees up cash for repayments.

Steps to build your budget:

- Track your monthly income (after taxes)

- List all your fixed and variable expenses

- Identify areas where you can cut back (e.g., dining out, subscriptions)

- Allocate a portion of your income specifically for debt repayment

Even small adjustments—like cutting a $100 monthly subscription—can make a big difference over time.

3. Choose a Debt Repayment Strategy

Once you have a budget, choose a debt repayment method that fits your personality and goals. Two of the most popular methods are:

✅ The Snowball Method

Focus on paying off the smallest debt first, while making minimum payments on the others. Once that’s paid off, move to the next smallest.

Why it works:

- Provides quick wins and boosts motivation

- Great for people who need momentum to stay consistent

Example:

- $500 credit card – Pay off first

- $1,500 medical bill – Pay off second

- $5,000 personal loan – Pay off third

✅ The Avalanche Method

Focus on the debt with the highest interest rate first, while making minimum payments on the others. This method saves you the most money over time.

Why it works:

- Minimizes the total interest paid

- Ideal for those focused on financial efficiency

Example:

- 24% APR credit card – Pay off first

- 15% APR personal loan – Pay off second

- 6% student loan – Pay off last

Tip: You can combine both methods—start with the snowball to gain motivation, then switch to the avalanche once you’re rolling.

4. Consider Debt Consolidation

Debt consolidation means combining multiple debts into a single loan or payment, often with a lower interest rate. This can simplify your payments and potentially reduce your monthly costs.

Options include:

- Debt consolidation loans – Personal loans that pay off multiple debts

- Balance transfer credit cards – Cards offering 0% APR for a limited time

- Home equity loans or lines of credit (HELOCs) – If you own property

Pros:

- Easier to manage one monthly payment

- Potentially lower interest rates

- Can help improve credit utilization ratio

Cons:

- May require good credit to qualify

- Risk of running up new debt if spending habits don’t change

- Fees or penalties may apply

Make sure the total cost (fees, interest, terms) is less than what you’re currently paying.

5. Talk to Your Creditors

If you’re struggling to keep up with payments, don’t ignore the problem. Many creditors are willing to work with you—especially if you reach out before you fall behind.

You can ask for:

- Lower interest rates

- Temporary payment plans

- Waived late fees

- Hardship programs

Be honest about your situation and provide a proposal for what you can afford. Many lenders would rather work with you than risk non-payment.

6. Avoid Taking on New Debt

While you’re working to pay down your existing debt, it’s essential to stop adding more.

Tips to avoid new debt:

- Pause credit card use or freeze cards in a safe place

- Use cash or debit for everyday purchases

- Delay large purchases unless they’re essential

- Avoid “buy now, pay later” plans unless you’re 100% sure you can pay on time

Think of this as a reset period for your financial health.

7. Build a Small Emergency Fund

It might seem counterintuitive, but having a small emergency fund (even $500–$1,000) can help you avoid going back into debt when unexpected expenses arise.

Start small, and build this cushion over time, so you’re not forced to rely on credit cards during emergencies.

8. Track Your Progress and Celebrate Wins

Paying off debt is a marathon, not a sprint. Keep track of your progress and celebrate milestones—whether it’s paying off your first credit card or cutting your total debt in half.

Use apps, charts, or journals to visualize your journey. Small victories can keep you motivated, especially during long stretches.

Final Thoughts

Managing debt effectively is about more than just numbers—it’s about creating new habits, staying consistent, and staying motivated. With the right strategy, tools, and mindset, you can reduce your debt, improve your credit, and take control of your financial future.

Whether you start with the snowball or the avalanche method, or choose to consolidate, the most important thing is to start now and stick with it.

Remember: every dollar you put toward debt today brings you one step closer to freedom tomorrow.