Current Financial Trends: Navigating Economic Shifts in 2025

As we progress through 2025, the global economic landscape is undergoing significant transformations that are influencing personal finances worldwide. From fluctuating interest rates to evolving trade dynamics and the rise of digital currencies, understanding these trends is crucial for making informed financial decisions.

1. Interest Rates on the Decline

In response to previous economic challenges, central banks across major economies are adopting a more dovish stance. The U.S. Federal Reserve, for instance, has signaled a cautious approach to monetary policy, opting for patience as it assesses the impact of recent import tariffs. Fed officials have indicated that there is no immediate need to adjust interest rates before clearer data emerges, likely by the second half of 2025 .

This trend is mirrored globally. The European Central Bank is expected to lower its policy rate to a terminal rate of 1.75%, while the Bank of Japan is projected to lift its policy rate to 0.75% by the end of 2025 . For consumers, this environment may present opportunities for lower borrowing costs, making it an opportune time to consider refinancing loans or taking out mortgages.

2. Trade Tensions and Their Economic Impact

Trade policies continue to be a significant factor influencing global markets. The U.S. administration’s implementation of new tariffs has introduced volatility and uncertainty, prompting businesses to reassess investment strategies. The International Monetary Fund (IMF) has urged countries to resolve escalating trade disputes swiftly, as ongoing tensions threaten global economic stability and growth .

For individuals, these developments can affect the prices of imported goods, potentially leading to increased costs for everyday items. It’s advisable to stay informed about changes in trade policies and adjust spending habits accordingly.

3. Global Economic Growth Projections

Despite challenges, the global economy is projected to experience steady growth in 2025. Goldman Sachs forecasts a 2.7% expansion in global GDP, with the U.S. economy leading the way at a projected growth rate of 2.5% . However, the euro area is expected to lag behind, with a growth rate of 0.8%.

For investors, these projections suggest a cautiously optimistic outlook. Diversifying investment portfolios and focusing on sectors poised for growth can help mitigate risks associated with regional economic disparities.

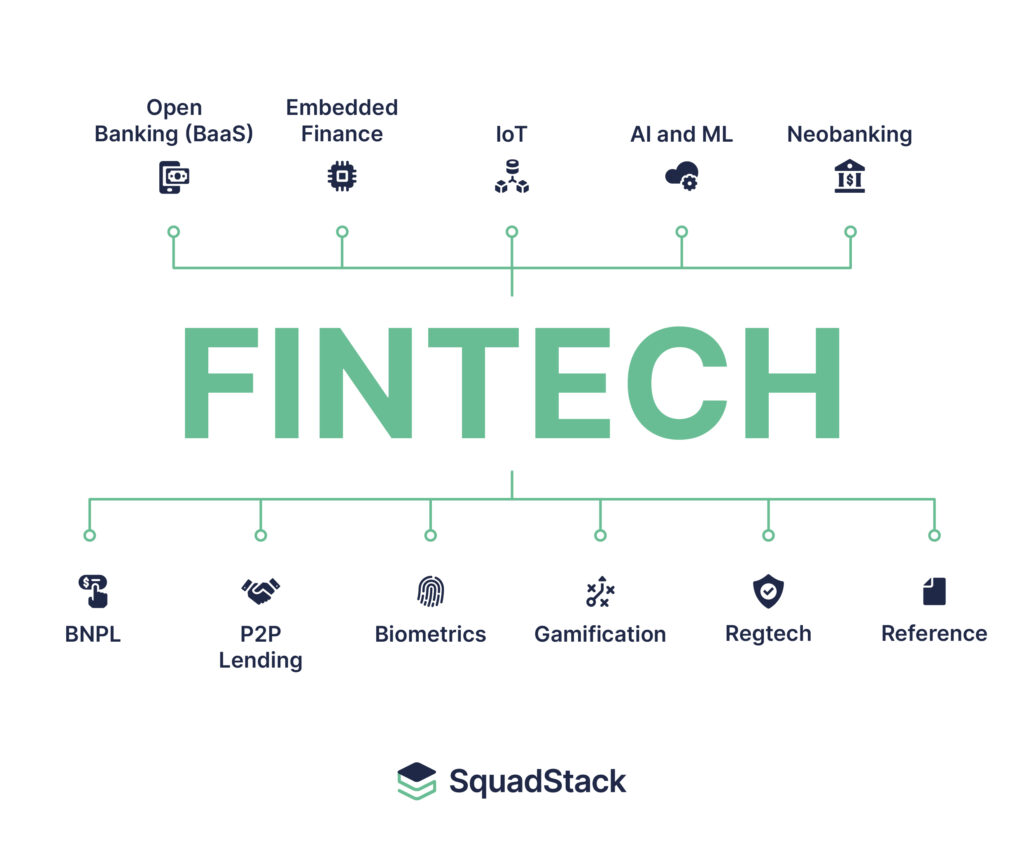

4. The Rise of Digital Currencies and Decentralized Finance

The financial sector is witnessing a shift towards digital currencies and decentralized finance (DeFi) platforms. Central Bank Digital Currencies (CBDCs) are being explored by several countries to enhance transaction efficiency and transparency. Additionally, DeFi platforms are gaining traction, offering alternative financial services without traditional intermediaries .

For consumers, this evolution presents new opportunities and risks. Engaging with digital currencies and DeFi platforms requires a solid understanding of the technologies involved and the regulatory landscape. It’s essential to approach these innovations with caution and seek professional advice when necessary.

5. Sustainability and Ethical Investing

Environmental, social, and governance (ESG) factors are becoming increasingly important in investment decisions. Consumers are placing greater emphasis on sustainability and ethical considerations, with over 60% of individuals choosing products and services based on their environmental and social impact .

For investors, integrating ESG criteria into investment strategies can align financial goals with personal values. However, it’s crucial to conduct thorough research to ensure that investments genuinely meet ESG standards and offer competitive returns.

6. Inflation and Cost of Living Pressures

Inflation remains a concern in many regions, impacting the cost of living. In the UK, for example, consumer confidence has declined due to financial market instability and renewed inflation concerns triggered by new tariffs .

For individuals, managing expenses becomes paramount. Strategies such as budgeting, reducing discretionary spending, and seeking cost-effective alternatives can help mitigate the impact of rising prices.

7. The Shift Towards Mindful Spending

In response to economic uncertainties, consumers are adopting more mindful spending habits. Many individuals are focusing on sustainability, ethical spending, and conscious budgeting, where every dollar spent has a purpose .

For consumers, this trend encourages a more deliberate approach to financial decisions. Evaluating the long-term value and impact of purchases can lead to more satisfying and financially sound choices.

Conclusion

Navigating the financial landscape of 2025 requires adaptability and awareness of emerging trends. By staying informed about interest rate changes, trade policies, digital currency developments, and shifting consumer behaviors, individuals can make proactive decisions to safeguard and grow their financial well-being.

As the global economy continues to evolve, embracing a mindset of continuous learning and prudent financial management will be key to thriving in an increasingly complex financial world.