🛠️ Courses and Downloadable Resources: Empowering Your Financial Journey with eBooks, Templates, PDFs, and Online Courses

In today’s digital age, gaining financial knowledge and skills is more accessible than ever. Whether you’re a beginner eager to understand budgeting or an advanced investor looking for portfolio management strategies, online courses and downloadable resources provide powerful tools to boost your financial literacy and confidence.

This article explores the value of financial courses and downloadable resources, the types available, and how to leverage them to improve your money management and achieve your financial goals.

Why Online Courses and Downloadable Resources Matter

Financial education is the foundation for sound money management, smart investing, and long-term financial security. However, traditional education often overlooks practical money skills, leaving many feeling unprepared.

Online courses and downloadable resources bridge this gap by offering flexible, affordable, and personalized learning experiences. They allow you to:

- Learn at your own pace and schedule.

- Access expert knowledge without costly seminars or advisors.

- Apply lessons immediately with practical tools.

- Revisit content anytime for refresher or deeper understanding.

These resources make financial education approachable and actionable for anyone, regardless of background or income level.

Types of Financial Courses Available

1. Budgeting and Personal Finance

Courses focused on basics like budgeting, saving, debt management, and credit improvement teach you how to build a stable financial foundation.

2. Investing and Wealth Building

From stock market fundamentals to retirement planning, these courses guide you through strategies to grow and protect your wealth.

3. Entrepreneurship and Small Business Finance

If you run a business or freelance, these courses cover cash flow management, taxes, invoicing, and business credit.

4. Real Estate and Alternative Investments

Explore courses on property investing, REITs, or alternative assets like cryptocurrencies and collectibles.

5. Financial Psychology and Mindset

Courses that address behavioral finance and money mindset help you overcome emotional barriers to financial success.

Popular Downloadable Resources for Finance

Alongside courses, downloadable materials enhance your learning and provide ongoing support.

1. eBooks

Comprehensive guides or mini-books on specific topics allow deep dives into concepts with examples and exercises.

2. Excel Templates

Pre-built spreadsheets for budgeting, debt tracking, investment analysis, and retirement planning simplify calculations and visualize your finances.

3. PDF Checklists and Worksheets

Printable worksheets help you organize financial goals, create action plans, or prepare for tax season.

4. Financial Calculators

Interactive spreadsheets or PDF tools that calculate loan payments, compound interest, savings goals, or net worth.

How to Choose the Right Courses and Resources

With so many options, selecting the best fit can feel overwhelming. Here are some tips:

- Identify your goals: Are you learning to get out of debt, start investing, or manage a business? Choose courses focused on your priority.

- Check credentials: Look for instructors with verified expertise and positive reviews.

- Consider format: Videos, text, quizzes, or live sessions cater to different learning styles.

- Look for practical tools: Resources like templates and calculators enhance application.

- Start small: Free or low-cost introductory courses let you test the content before deeper investment.

Benefits of Combining Courses with Downloadable Resources

Combining interactive courses with downloadable materials maximizes learning:

- Retention improves when you apply concepts using templates or worksheets.

- Tracking progress becomes easier with checklists and planners.

- Confidence grows as you build a personalized financial system.

- Flexibility increases since you can learn online and work offline.

Tips for Getting the Most from Financial Courses and Resources

1. Set Clear Learning Objectives

Define what you want to achieve from each course or resource to stay focused.

2. Schedule Dedicated Time

Treat learning like an appointment to maintain consistency.

3. Engage Actively

Take notes, complete exercises, and participate in discussion forums if available.

4. Apply Lessons Immediately

Use budgeting templates or investment trackers to put knowledge into action.

5. Review and Update Regularly

Return to resources periodically to refresh skills and adjust plans as life changes.

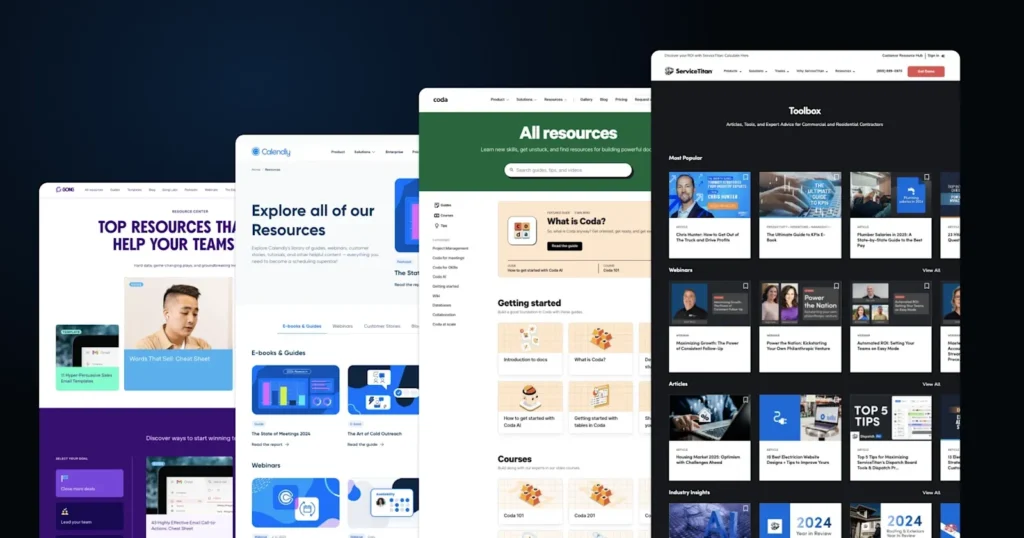

Examples of Top Platforms Offering Finance Courses and Resources

- Coursera and edX: Offer courses from universities on personal finance and investing.

- Udemy and Skillshare: Provide practical courses from industry experts and entrepreneurs.

- Khan Academy: Free lessons on basic finance concepts.

- Financial blogs and websites: Often provide downloadable budgeting sheets and eBooks.

- Financial institutions: Some banks and credit unions offer free educational tools for customers.

The Future of Financial Education: Interactive and Personalized

The digital landscape is rapidly evolving with technologies like AI tutors, gamification, and mobile apps that personalize financial education. These innovations promise even more engaging and effective learning experiences, empowering users to master their finances anytime, anywhere.

Conclusion

Courses and downloadable resources have revolutionized how we access financial education. By leveraging eBooks, Excel templates, PDFs, and online classes, you can gain practical skills, boost confidence, and make smarter money decisions at your own pace.

Whether you’re just starting out or looking to deepen your knowledge, these tools offer flexible, cost-effective ways to build a strong financial foundation and work toward your goals.

Start exploring the wealth of available resources today, commit to ongoing learning, and watch your financial well-being grow.