1. Track Your Spending Habits

The first step to saving money efficiently is understanding where your money is going. Tracking your spending allows you to identify areas where you can cut back. Start by reviewing your bank statements or using a budgeting app to categorize your expenses. Look for patterns in your spending—perhaps you’re spending more than you realized on dining out, subscription services, or impulse purchases.

Once you have a clear picture of your spending habits, create a budget that prioritizes your essential needs, like housing, utilities, and groceries, while setting limits for discretionary spending. The goal is not to eliminate all enjoyment, but to become more mindful about where your money is going and make smarter decisions.

2. Create a Realistic Budget

A well-planned budget is the cornerstone of saving money efficiently. The 50/30/20 rule is a simple and effective approach to budgeting. Allocate 50% of your income to essential expenses, like rent or mortgage, utilities, and groceries. Dedicate 30% to non-essential or discretionary expenses, such as entertainment, dining out, and hobbies. Lastly, commit 20% of your income to savings and debt repayment.

The key to a successful budget is to make it realistic and flexible. If you set yourself an overly restrictive budget, it may be hard to stick to it. Instead, aim for gradual adjustments over time as you track your progress. Be sure to account for seasonal variations in expenses, such as holidays or annual subscriptions, to avoid surprises.

3. Cut Down on Subscriptions and Recurring Expenses

Subscription services have become an integral part of modern life, but many people sign up for them without considering whether they use them regularly. Streaming platforms, magazine subscriptions, fitness apps, and even cloud storage services can quickly add up.

Take a close look at your subscription list and ask yourself if you’re using each one regularly. Do you really need all those TV streaming services, or could you share a plan with a friend or family member? Cancel subscriptions that you no longer use or need. In addition, review your insurance plans, phone contracts, and utility services to see if there are more affordable alternatives or bundles that better suit your needs.

4. Cut Grocery Costs Without Sacrificing Quality

Grocery bills are one of the most significant household expenses. However, there are several ways to reduce grocery costs without sacrificing the quality of your meals. Start by planning your meals for the week. Meal planning helps prevent impulse purchases and allows you to buy ingredients in bulk, which can be more affordable.

Take advantage of sales, discounts, and loyalty programs offered by grocery stores. Shopping for store brands, rather than name-brand products, is another way to save without compromising quality. Additionally, buy fresh produce in season, as it’s typically less expensive than out-of-season options. Finally, consider using cashback apps or digital coupons to save even more at checkout.

5. Adopt Energy-Efficient Habits

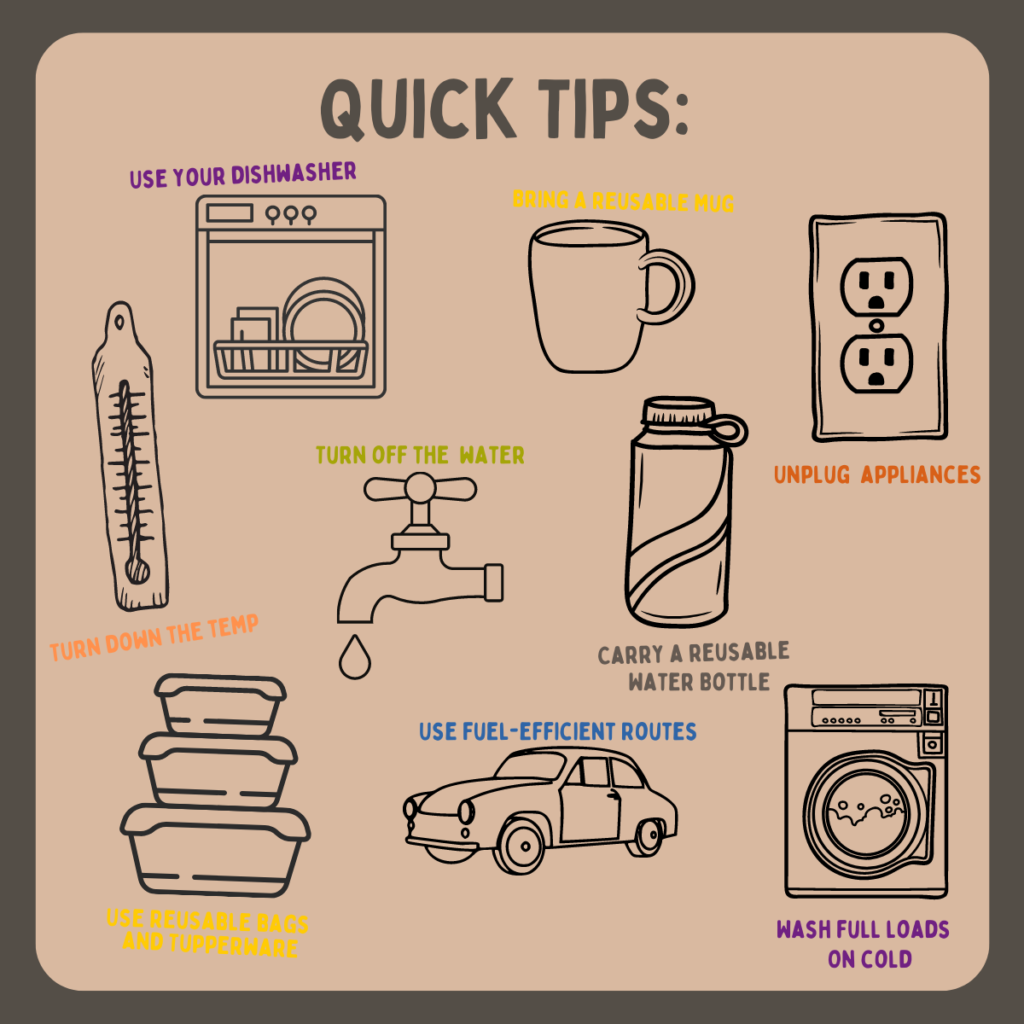

Reducing your energy consumption is an effective way to save money on utility bills. Simple changes like turning off lights when not in use, unplugging electronics, and using energy-efficient appliances can significantly lower your monthly bills.

Investing in energy-saving upgrades, such as LED light bulbs, programmable thermostats, or low-flow showerheads, can also provide long-term savings. Another useful habit is to optimize your heating and cooling systems. For example, setting your thermostat lower in winter and higher in summer can reduce energy usage without sacrificing comfort.

6. Shop Smart and Use Discounts

When making purchases, whether online or in-store, always be on the lookout for ways to get the best deal. Before making a purchase, do some research to compare prices across different stores or websites. Many online retailers offer price match guarantees, meaning they’ll match a competitor’s price if you find a better deal.

Take advantage of seasonal sales, clearance items, and special promotions. Signing up for store newsletters or loyalty programs can also lead to exclusive discounts and early access to sales. Additionally, using cashback websites or credit cards with rewards can provide you with extra savings or points for future purchases.

7. Opt for Public Transportation or Carpooling

Transportation costs can be a significant drain on your finances, especially if you drive a car daily. The price of gas, parking, maintenance, and insurance can quickly add up. If possible, consider using public transportation or carpooling to reduce these expenses. Many cities offer affordable public transportation options that can be more cost-effective than owning a car.

If public transit isn’t an option, try carpooling with colleagues or friends who live nearby and have similar work schedules. Not only will this help you save on gas, but it can also reduce wear and tear on your vehicle, extending its lifespan.

8. Minimize Debt and Interest Payments

High-interest debt, such as credit card debt, can be a major obstacle to saving money efficiently. To minimize debt, focus on paying off high-interest balances as quickly as possible. Start by prioritizing debt with the highest interest rates, which will save you more money in the long run.

Consolidating debt or refinancing loans to secure a lower interest rate can also help reduce your monthly payments. Avoid taking on additional debt unless absolutely necessary. By eliminating or minimizing debt, you free up more money to put toward savings.

9. Automate Your Savings

One of the easiest ways to save money efficiently is to automate your savings. Set up automatic transfers to your savings or retirement accounts each month, ideally as soon as you receive your paycheck. This way, you won’t be tempted to spend that money, and it will accumulate over time without you having to think about it.

If you’re saving for specific goals, such as a vacation or an emergency fund, consider setting up separate savings accounts for each goal. This helps you stay organized and focused on your objectives.

10. Embrace the “Frugal” Mindset

Lastly, developing a frugal mindset can significantly improve your ability to save money. Being frugal doesn’t mean depriving yourself—it means making thoughtful choices that prioritize value over impulse. Look for opportunities to save on everyday purchases, whether it’s buying secondhand items, cooking at home, or choosing experiences over material possessions.

By embracing a frugal mindset, you’ll start to view saving money as an empowering habit rather than a restriction, leading to long-term financial stability and success.

Conclusion

Saving money efficiently doesn’t require drastic lifestyle changes. Instead, small, mindful adjustments to your daily habits can lead to significant savings over time. By tracking your spending, creating a realistic budget, cutting down on unnecessary expenses, and making smarter purchasing decisions, you can reduce your financial stress and build a healthier financial future. Start by implementing a few of these tips today, and gradually incorporate more strategies as you become more comfortable with your financial goals. With patience and discipline, saving money will become second nature.