🏦 Financial Product Comparisons: How to Choose the Best Credit Cards, Bank Accounts, Loans, and Mortgages

In today’s financial landscape, consumers have more options than ever before. Whether you’re choosing a credit card, opening a bank account, applying for a personal loan, or searching for the right mortgage, comparing products is essential to make informed decisions and get the most value for your money.

This article will guide you through the key factors to consider when comparing these common financial products—focusing on interest rates, fees, and benefits—so you can pick the right tools to fit your financial goals and lifestyle.

💳 Credit Cards: Finding the Right Fit for Your Spending

Credit cards are versatile financial tools that can help you manage expenses, build credit history, and earn rewards. However, not all credit cards are created equal, and selecting the right one depends largely on your habits and needs.

What to Compare:

- Interest Rates (APR): The annual percentage rate determines how much interest you’ll pay if you carry a balance. Lower APRs save you money if you don’t pay in full.

- Annual Fees: Some cards charge a yearly fee for premium benefits, while others are free.

- Rewards & Benefits: Look for cashback, points, travel miles, purchase protection, or perks like airport lounge access.

- Introductory Offers: Many cards offer 0% APR for a period or sign-up bonuses.

- Credit Requirements: Some cards require excellent credit, while others are designed for rebuilding or building credit.

Example:

If you spend a lot on groceries and gas, a card offering higher cashback in those categories may be worth an annual fee. But if you pay off your balance monthly, a no-fee card with a low APR could be better.

🏦 Bank Accounts: Balancing Costs and Convenience

Bank accounts are the foundation of your financial life, whether checking accounts for everyday transactions or savings accounts to build your emergency fund.

What to Compare:

- Fees and Minimum Balances: Watch out for monthly maintenance fees or minimum balance requirements to avoid charges.

- Interest Rates on Savings: Look for accounts with competitive interest to help your savings grow.

- Accessibility: Consider online banking features, mobile app quality, ATM networks, and branch availability.

- Transaction Limits: Some savings accounts limit withdrawals or transfers.

- Additional Services: Overdraft protection, linked accounts, and customer support quality.

Digital vs. Traditional Banks:

Online banks often offer higher interest rates and lower fees but lack physical branches. Choose based on your preference for convenience versus in-person service.

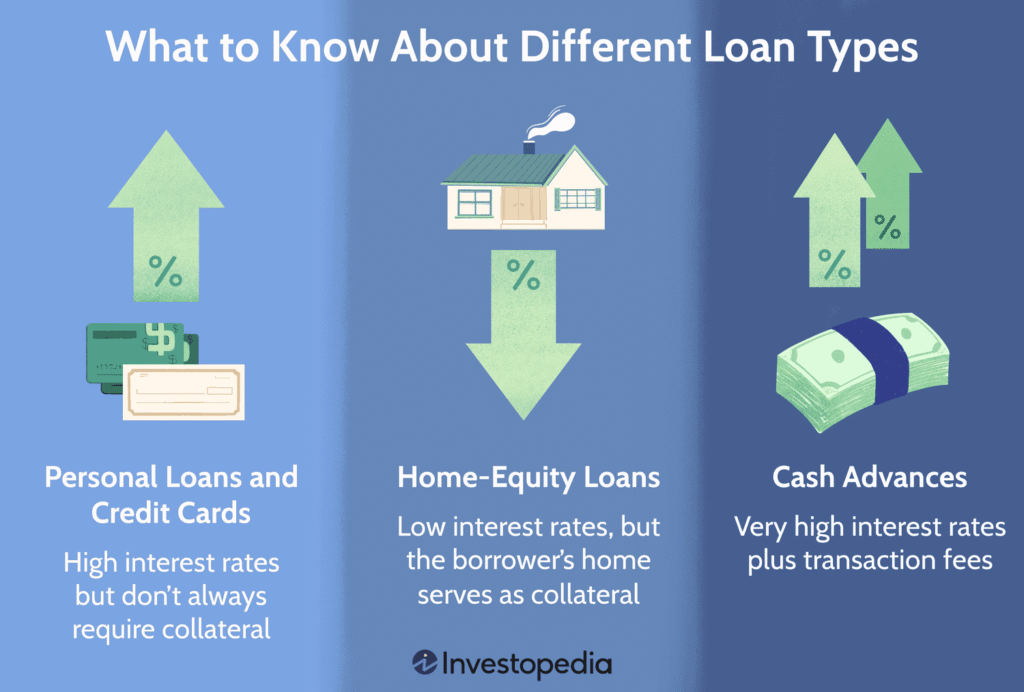

💸 Personal Loans: Financing Your Needs Wisely

Personal loans can be useful for consolidating debt, making a large purchase, or covering unexpected expenses. But to avoid costly mistakes, comparing loan offers carefully is crucial.

What to Compare:

- Interest Rates: Fixed or variable rates can vary widely; a lower rate means less interest paid over time.

- Loan Term: Longer terms lower monthly payments but increase total interest.

- Fees: Look for origination fees, prepayment penalties, or late payment charges.

- Approval Process: Some lenders offer quick online approvals, while others require more documentation.

- Flexibility: Check if you can make extra payments without penalties to pay off the loan sooner.

Tip:

Use loan calculators to understand total costs and monthly payments before committing.

🏡 Mortgages: Planning for the Biggest Financial Commitment

Buying a home is a significant milestone and a long-term financial commitment. Choosing the right mortgage product can save you tens of thousands of dollars over the life of your loan.

What to Compare:

- Interest Rates: Fixed rates offer payment stability; variable rates may start lower but can change.

- Loan Term: Typical mortgage terms are 15 or 30 years. Shorter terms save interest but increase monthly payments.

- Down Payment Requirements: Some lenders require larger down payments, which affect your loan-to-value ratio.

- Closing Costs and Fees: These include appraisal, origination, title insurance, and other processing fees.

- Prepayment Options: Verify if you can pay extra toward principal without penalties.

Shopping Around:

Get quotes from multiple lenders and consider all costs, not just the interest rate. Even a small difference in rate can add up to big savings.

🧠 Smart Tips for Comparing Financial Products

- Make a Comparison Chart: List products side-by-side to see differences clearly.

- Know Your Needs: Identify which features matter most—low fees, rewards, interest savings, or flexibility.

- Read the Fine Print: Terms and conditions can contain important restrictions or fees.

- Check Reviews and Ratings: Customer experiences often reveal hidden pros and cons.

- Update Regularly: Financial products evolve, so review your choices periodically.

✅ Final Thoughts: Choosing the Best Products Saves You Money and Stress

Financial products are tools—choosing the right ones can help you achieve your goals faster, avoid unnecessary costs, and build financial security. Taking time to compare credit cards, bank accounts, personal loans, and mortgages by their interest rates, fees, and benefits is one of the smartest moves you can make.

Remember, the “best” product isn’t always the one with the lowest fees or highest rewards; it’s the one that fits your unique financial situation and helps you meet your goals comfortably.

🔎 Explore Our Comparison Tools

To help you get started, check out our interactive comparison tools for:

- Credit Cards

- Bank Accounts

- Personal Loans

- Mortgages

Empower yourself with knowledge—and take confident steps toward financial wellness.